|

|

By contributing to a pension fund, your future is somewhat protected (in financial

terms). The additional savings will help to avoid a huge drop in living standards

when you retire. The automatic regular contributions be it from the employer or employee

are relatively painless. But over the long-term with careful investing, the proceeds

can be substantial. With good planning, some pension funds provide superior returns

upon retirement.

In addition, dependency on your children to provide for you will be reduced if one

has saved enough for retirement. Gone are the days where parents needed to have lots

of children in order to ensure that someone will "look after them" in their

old age.

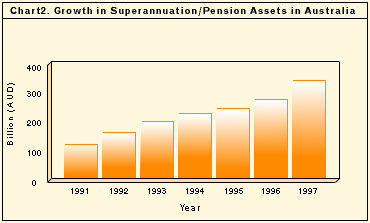

Contributing to pension funds not only cultivates the savings habits it helps to

contribute to the economy when the fund invests back into the country. If we look

at the international scene, the growth of pension funds in international markets

have been notable. In Australia for instance, the growth in Superannuating/pension

assets grew more than 130% from 1991 to 1997 as more people grew wise to the need

to prepare for retirement (Chart 2).

Source: Insurance and Superannuation Commission Sept 1997

Malaysians are slowly moving into the scene as well. Table 2 shows there are many

savings and investment schemes have been formed by employers in Malaysia.

|

Table 2. The Saving and Investment Schemes

formed by Employers in Malaysia

|

|

Types of

Schemes

|

Number of

Schemes

|

Number of

Companies

|

Employees Involved

|

|

Investment and

Unit Trust

|

52

|

45

|

22,282

|

|

Workers Pension

Fund

|

3

|

3

|

4,420

|

|

Savings Fund

|

61

|

61

|

25,184

|

|

Insurance Scheme

|

90

|

90

|

37,274

|

|

Workers Cooperative

|

7

|

70

|

2,784

|

|

Agriculture Scheme

|

1

|

1

|

900

|

Source: Human Resources Ministry

Employers response to the workers savings campaign has so far been very positive.

As at December I 997, the Labour Department has approved 214 types of savings funds

and schemes, involving 92,844 workers in 202 companies in the country.

It is evident that many realize the effort of contributing to pension or savings

scheme as part of their retirement planning. Joining a pension fund does not merely

benefit the individuals. Next week- employers can benefit pension funds as well.

|