|

The types of insurance are:

This is the simplest form and least expensive of life insurance and is also known

as temporary insurance. The sum assured under the policy is payable only in the event

of death of the life assured within the stipulated term of the policy. Nothing is

paid if the life assured survives the term. This is most suited for people wanting

to cover themselves at minimal cost during a period of life when they have the most

commitments.

An example is the Mortgage Reducing Term Assurance which is a cover for the cost

of house purchased i.e. the balance of the housing loan will be fully settled by

the insurance company in the event of death or permanent disability of the purchaser.

This is where life insurance protection is provided for the whole duration of life

with the sum assured including any accrued bonuses becoming payable upon the death

of life assured. There is also an element of savings here, as, if the life assured

survives his pensionable age, there is a cash value.

This is useful as an incentive to save with the benefit of insurance protection,

is a convenient means of providing for old age and of hedging against the possibility

of untimely death.

The more popular endowment policies are for education purposes, whereby the parent

wants to protect his child's education fund.

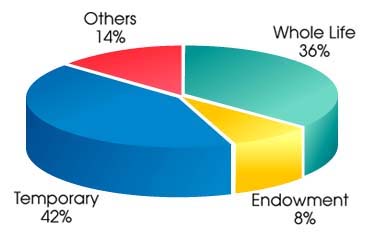

Chart 1 1994 - Distribution of New Sums Insured

Source: Annual Report of the Director General of Insurance 1995

As an illustration of a whole of life insurance cover we take a young executive

aged 26:

Salary : RM2,000 x 12 = 24,000 per annum

Expenses : RM1,200 per month

Savings : RM800 per month

The executive takes up a whole of life policy of RM100,000. Monthly premium is

approximately RM200. Since the insurance company pays out cash bonus on the premiums

paid, premium payments can be paid via the bonuses and therefore can effectively

be stopped after several years. The cover will go on until the executive turns 65

years old if no claims are made.

From a savings point of view, after 29 years i.e. executive is now 55 years old

and having paid RM33,600 in premiums, the cash value of the policy would be about

RM80,000 which can be withdrawn and used as a retirement benefit. The return is approximately

4.8% which is about the same as the savings rate. If he stretches it out until the

turns 65, the cash value is about RM134,000. The return of 7.7% here is equal or

even better than fixed deposits.

From a coverage point of view, if the executive dies at the age of 50, his next

of kin will receive a death benefit of about RM216,000. The same amount will be paid

out if he suffers from a stroke and becomes permanently disabled, which can be useful

in taking care of medical costs that has exceeded his employer's limit.

It is reported that Bank Negara will pursue vigorous policy initiatives to quickly

develop the insurance sector as a key component of the financial services sector.

One of the targets of the insurance industry by the year 2000 is that one in every

two persons should hold a life policy.

As can be seen from the above illustration, insurance is a must to protect your

family in case something unexpected happens. It is a vital part in financial planning.

For most of us, it is wise to have insurance cover and invest the balance of the

funds in other savings plans that are available in the market.

Adopting this course of action (insurance and other savings plans) will result

in, you as the investor being able to have your cake and eat it. Something we don't

have an opportunity to do often.

|